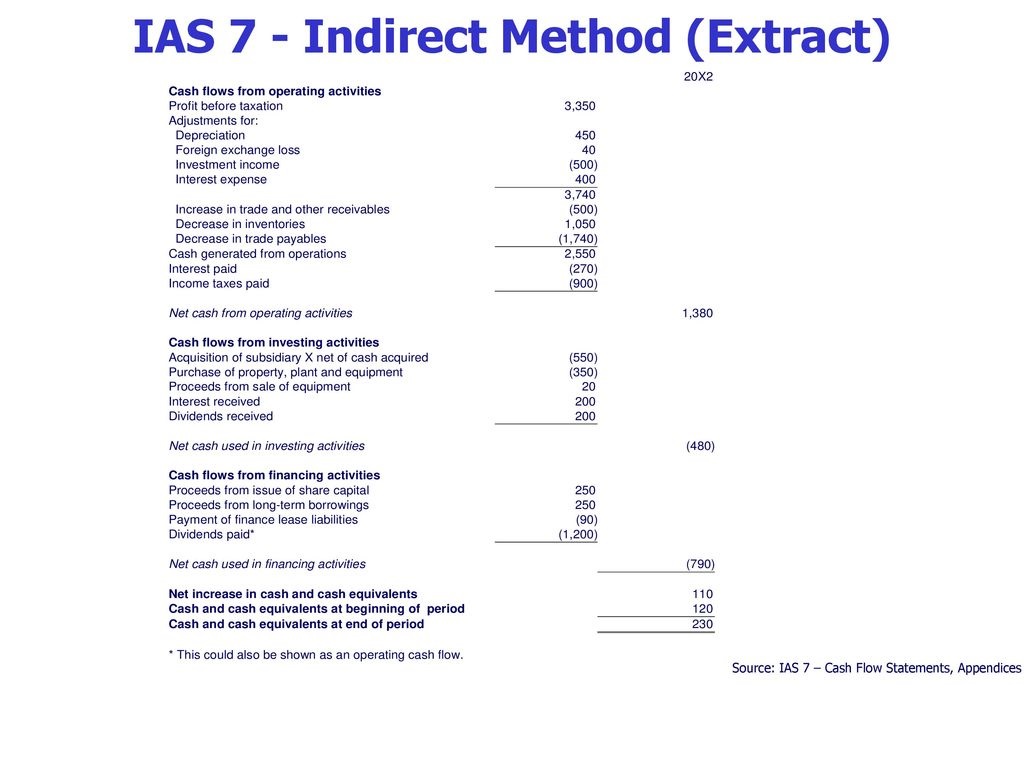

The indirect method of presentation is very popular, because the information required for it is relatively easily assembled from the accounts that a business normally maintains in its chart of accounts. The indirect method is less favored by the standard-setting bodies, since it does not give a clear view of how cash flows through a business.

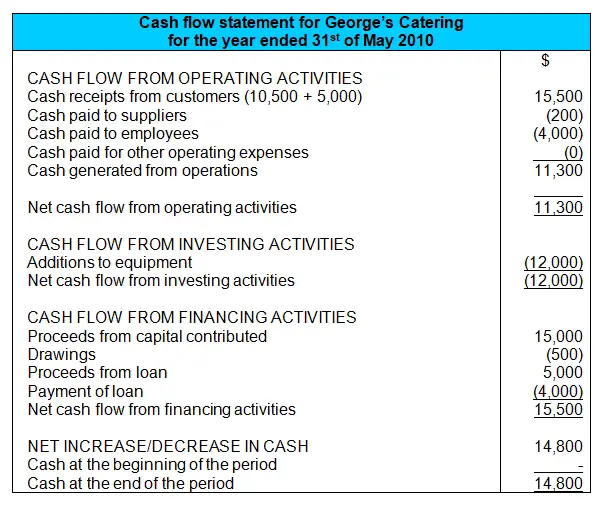

The format of the indirect method appears in the following example. In the presentation format, cash flows are divided into the following general classifications: It presents information about cash generated from operations and the effects of various changes in the balance sheet on a company's cash position. Presentation of the Statement of Cash Flows Profit before interest and income taxes, xx,xxx Add back depreciation, xx,xxx Add back impairment of assets, xx. In financial accounting, a cash flow statement, also known as statement of cash flows or funds flow statement, is a financial statement that shows how changes. The statement of cash flows is one of the components of a company's set of financial statements, and is used to reveal the sources and uses of cash by a business.

The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities.

0 kommentar(er)

0 kommentar(er)